Forex and Market Cryptocurrency Review

The foreign exchange market - also known as the forex or currency market - is the most heavily traded market in the world, with a turnover of $5.1 trillion a day*.

To put this in perspective, the U.S. stock market trades about $257 billion a day; a fairly large sum, but only a fraction of what is traded in the foreign exchange market.

The foreign exchange market trades 24 hours a day, 5 days a week, through banks, institutions and individual traders around the world. Unlike other financial markets, there is no centralized market for Forex, currencies are traded on whichever market is open at the time.

How foreign exchange trading works

Foreign exchange trading involves the simultaneous buying of one currency and selling of another. In the foreign exchange market, traders attempt to make profits by buying and selling currencies, actively speculating on the direction currencies may take in the future.

Want to know more about how to trade the forex market?

Our free Getting to Know Forex guide will cover how to get started, help you make your first trades and tell you how to create a long-term trading plan for long-term success.

*Average daily volume of the interbank foreign exchange market in April 2016, according to the Bank for International Settlements.

What is a cryptocurrency?

A cryptocurrency is a decentralized, digitally encrypted currency that is not connected to or controlled by any government or central bank, unlike traditional currencies such as the U.S. dollar (issued by the Federal Reserve), the euro (European Central Bank) or the Japanese yen (Bank of Japan), among many others.

Like these traditional currencies, cryptocurrencies typically serve two main functions:

Payment systems for goods and services.

Speculative instruments for trade and investment.

Popular cryptocurrencies:

- Bitcoin- Since its inception in 2009, Bitcoin has rapidly grown in importance as the world's first and most popular cryptocurrency.

- Litecoin - Launched in 2011, Litecoin is primarily used as a payment transaction cryptocurrency that has been called "the silver to Bitcoin's gold."

- Ethereum - Launched in 2015, Ethereum has quickly gained popularity on the heels of Bitcoin, and currently has a market capitalization second only to Bitcoin among cryptocurrencies.

- Ripple - Created in 2012, Ripple differs from Bitcoin in that it does not require mining to create the cryptocurrency.

- Dash - Launched in 2014, Dash, or Digital Cash, was initially known as "Darkcoin," and is unique in that it is considered a highly anonymous and secretive cryptocurrency that specializes in virtually untraceable transactions.

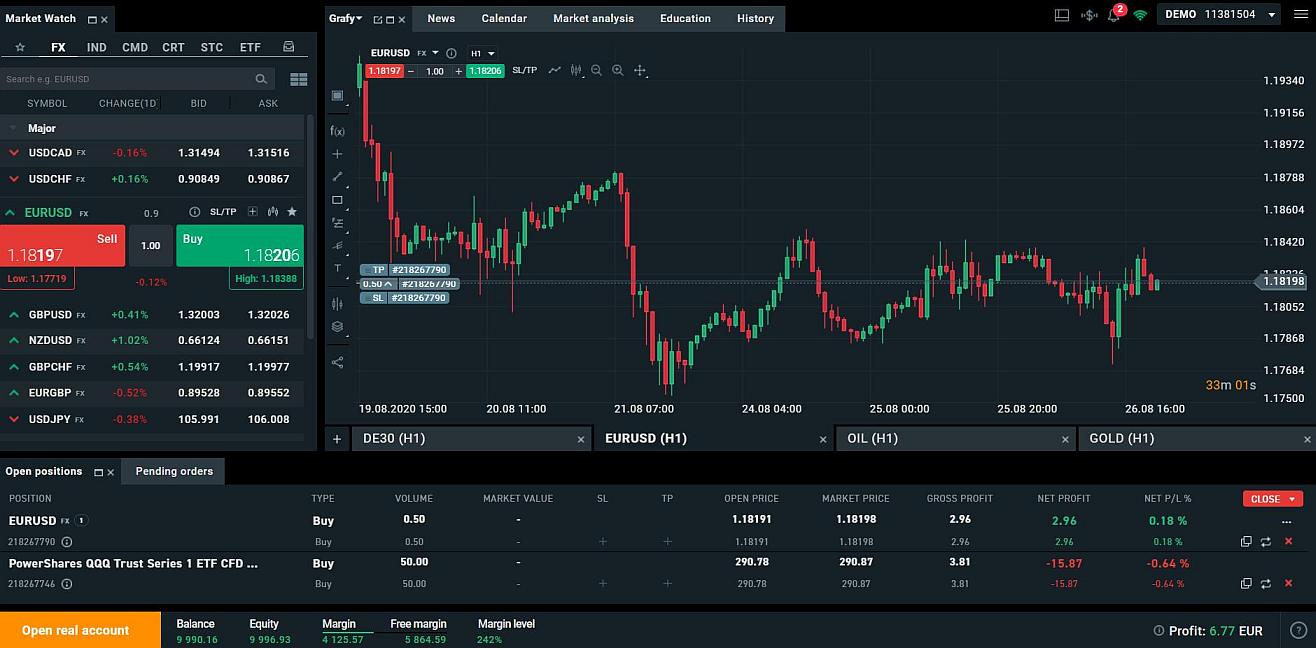

Orders are critical tools for any type of trader and should always be considered when executing against a trading strategy. Orders can be used to enter a trade as well as to help protect profits and limit downside risk.

Understanding the differences between the types of orders available can help you determine which orders best suit your needs and are best suited to help you achieve your trading goals.

Market

A market order is the most basic order type and is executed at the best price available at the time the order is received.

Limit

A limit order (also called a "take profit" order) is an order to buy or sell at a specified price or better. A sell limit order is executed at or above the specified price; buy limit orders are executed at or below the specified price.

Limit order

Limit orders allow you to be very precise in defining the entry or exit point of a trade. Note that limit orders do not guarantee entry or exit of a position, since if the specified price is not met, your order will not be executed. A limit order that is attached to a read more currently open position (or a pending entry order) for the purpose of closing that position may also be referred to as a "take profit" order.

Stop

A stop order triggers a market order when a predefined rate is reached. A buy stop order triggers a market order when the bid price is reached; a sell stop order triggers a market order when the ask price is reached. Both stop orders are executed at the best available price, depending on available liquidity. Stop orders, also called stop-loss orders, are often used to limit downside risk.